Newsletter #209 SVB, Bank Failures, BNPL

Bankruns, Bailouts, Buy-Now-Pay-Later

Announcements

Y’all I ripped up my pinky finger by scratching it when I was re-racking the dumbells at the gym on Monday….I need to do it one at a time…jeez I had to get stitches!

Weekly Shoutout

Shoutout to my mom for taking me to the emergency care after I cut myself at the gym!

Since I can’t drive these days I’m thankful I can rely on her!

Food for Thoughts

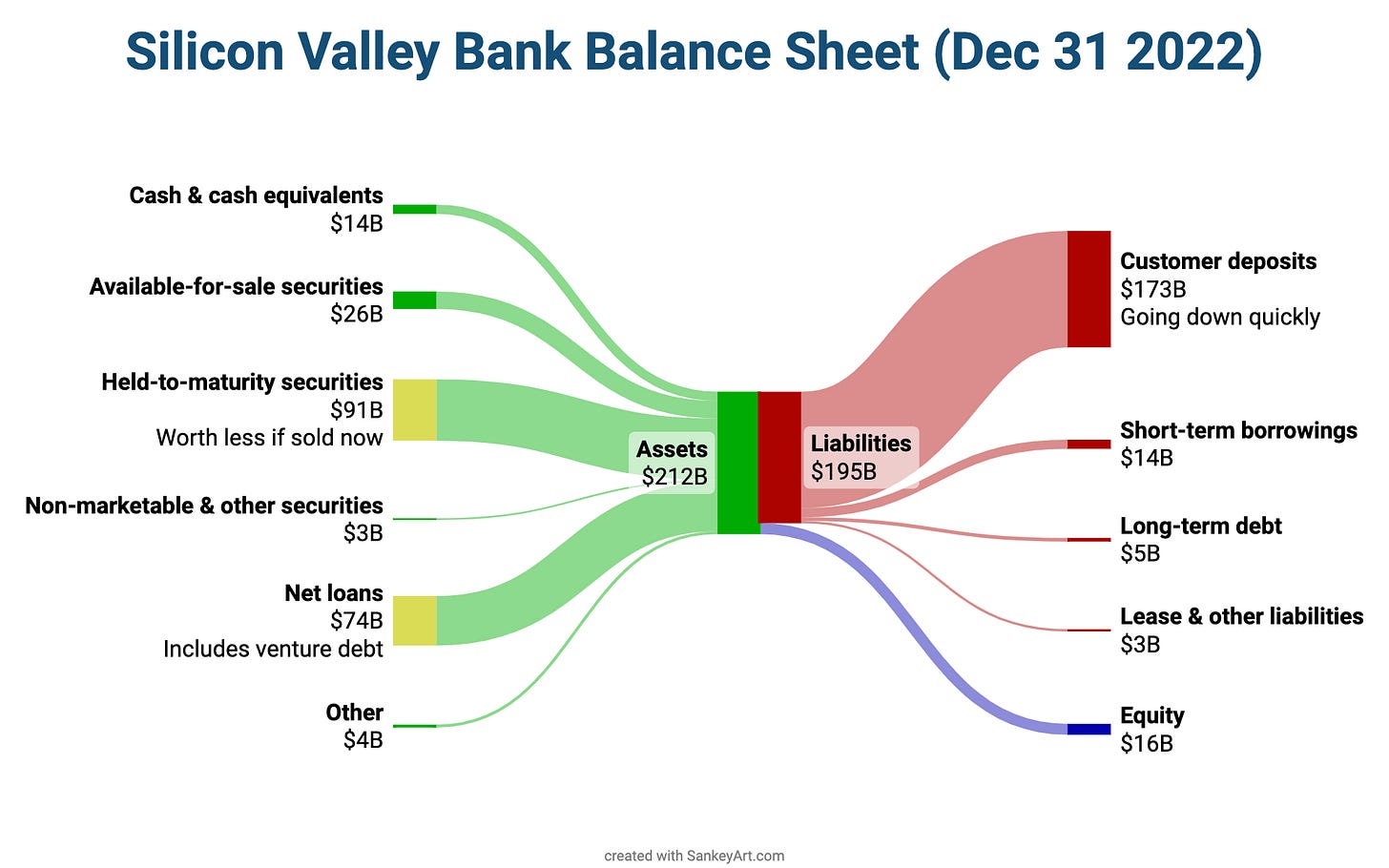

I found a nice viz of the balance sheet of Silicon Valley Bank at the end of last year, which shows that the 2nd largest asset at the bank after the MBS securities that crashed them is $74B of venture debt….

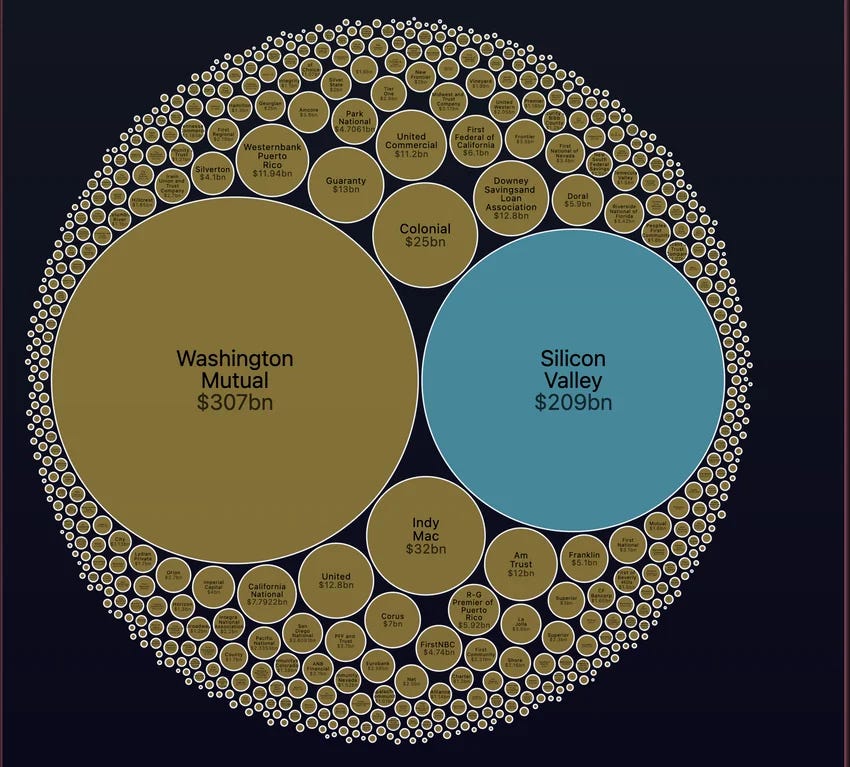

For context, the SVB collapse is now going down as the 2nd largest bank collapse, second only to Washington Mutual’s collapse in the middle of the 2008 Financial Crisis

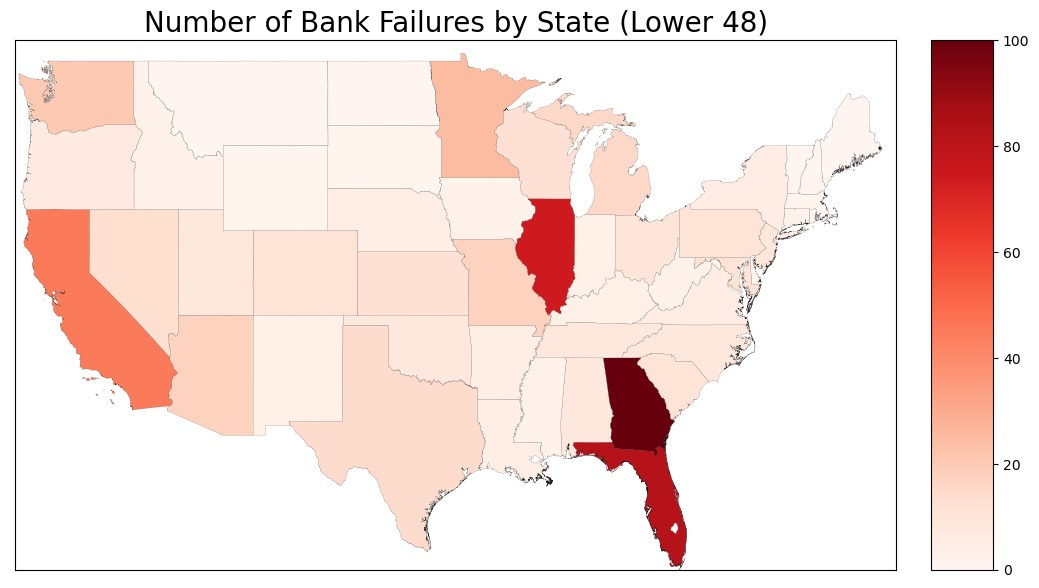

Whenever there is one bank run, the game theory of the situation makes everyone paranoid that bankruns at other smaller banks will happen, so let’s look at the how geographically concentrated bank failures have been up until no

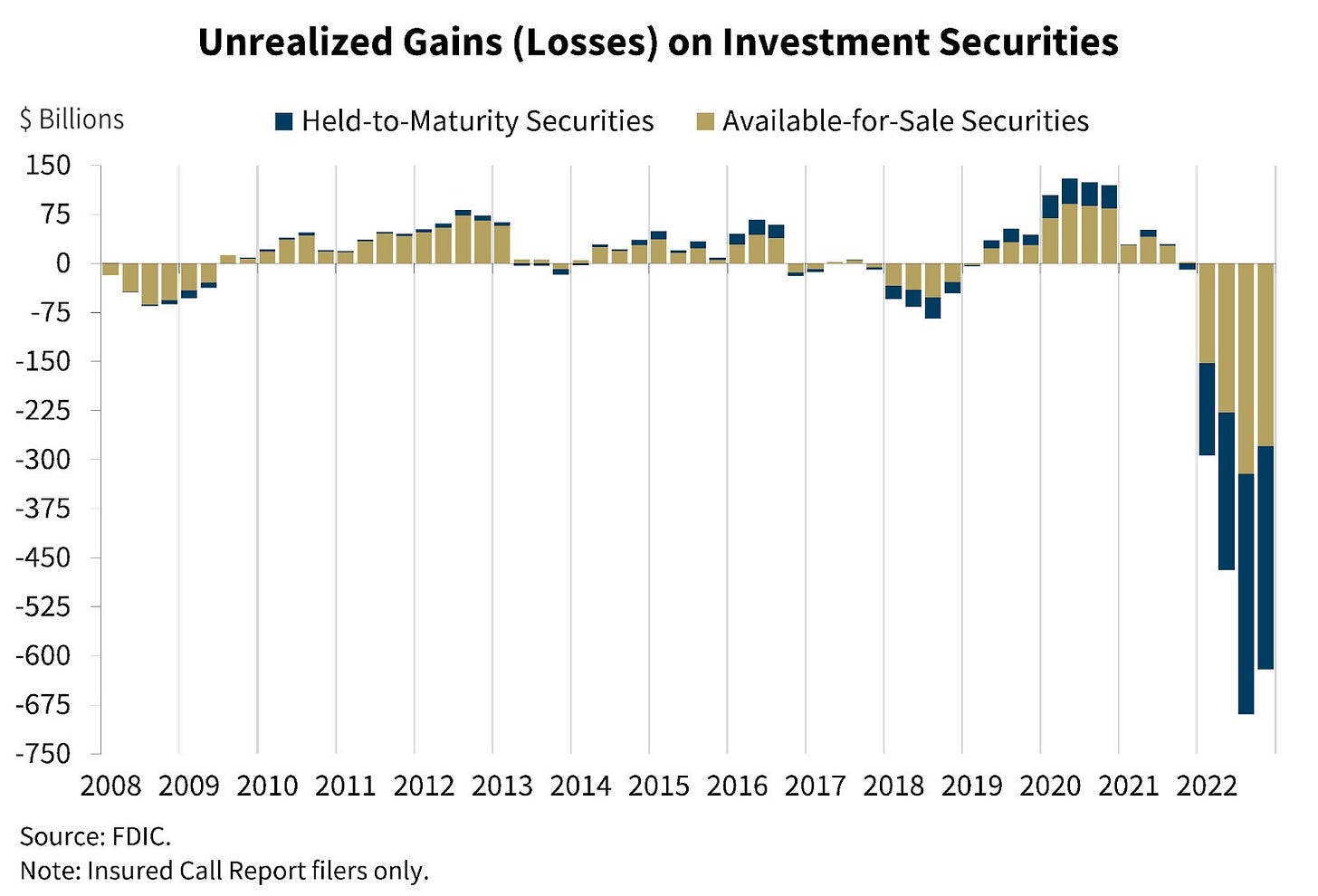

More broadly, the U.S. banking system has $620 billion in unrealized losses on “investment securities” which is way higher than the $130b in the Federal Deposit Insurance Fund (cite)

Crowd-Pleasers

Neobanks are uniquely struggling in this this new environment of higher rates, especially bc so many of them found product-market fit through buy-now-pay-later loans that are revealing themselves to be a bubble propped up by low-interest rates

“Of the 400 neobanks in the world, less than 5% are breaking even. Less than a handful of the 85 neobanks in the U.S. are breaking even; several are in the cash-burn zone losing as much as $140 per customer annually.” (cite)

From 2019 to 2021, the total value of buy-now, pay-later (or BNPL) loans originated in the United States grew more than 1,000 percent, from $2 billion to $24.2 billion.

BNPL providers can offer zero-percent interest rates because they charge merchants three to four times the average credit-card processing fee. (cite)

Mind-Benders

What disturbs me about the SVB collapse is that financial regulation tends to actually increase risk in a financial system bc it makes it harder to start new banks which further entrenches the pre-existing banks’ power creating too-big-to-fail risk!!

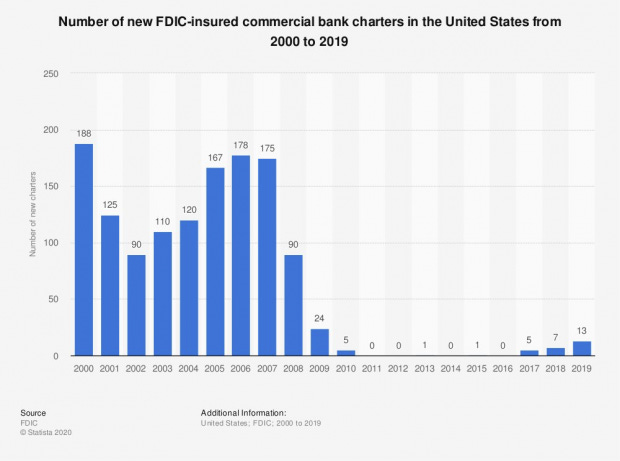

The number of new FDIC-insured banks charters has collapsed since the 2008 Financial Crisis, suggesting that Dodd-Frank might be a major reason for it since it’s not as if neobanks didn’t proliferate with the easy capital available this past decade

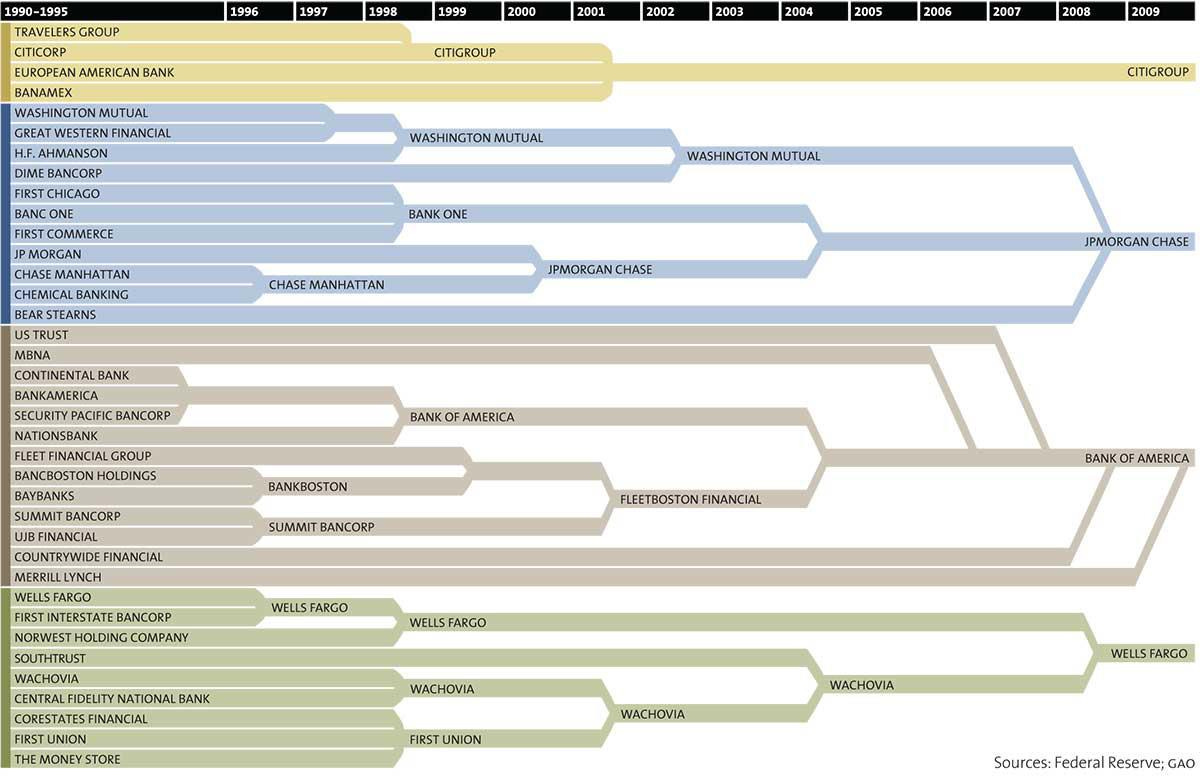

Look at how rapidly banks have consolidated into an oligopoly in the last 3 decades