Newsletter #292 Learning with Infographics, BS Financial Metrics, Drivers of Long-Term Profit

He is Risen!

Announcements

I’m back from Marocco. Y’all the sleep deprivation has really been killing me

Weekly Shoutout

Happy Easter everyone!

I celebrated it by watching Martin Scorsese’s The Last Temptation of Christ with @Qwelian and @Val

Food for Thought

I’m really excited about the new AI capabilities to make infographics, so I’m going through my backlog to find the most informative ones I have pinned

On a related note, I guess my constant accumulation, collection, and pinning of random information is turning out to be super useful for prompt engineering ahha

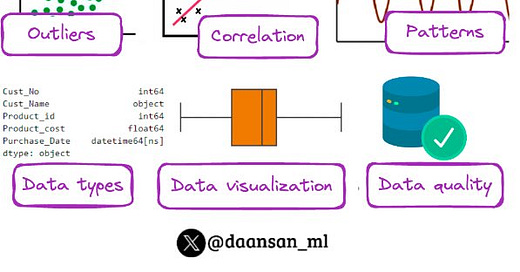

A few years when I was prepping for Data Science & ML interviews, I was struggling to recall all the steps in exploratory data analysis, and I made a checklist. I think this infographic is a good example of how to create a much more visually interesting checklist

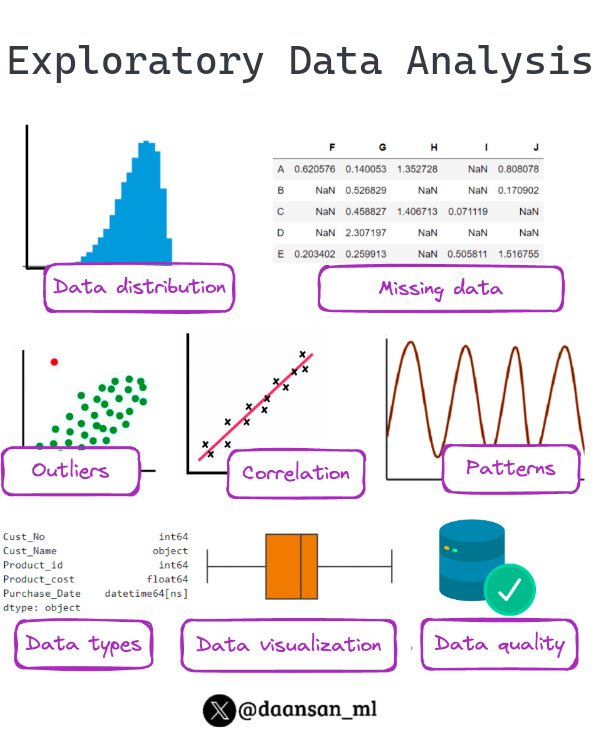

Beyond a basic checklist, then you have decision trees which could also be visualized. Ex. which chart should I use?

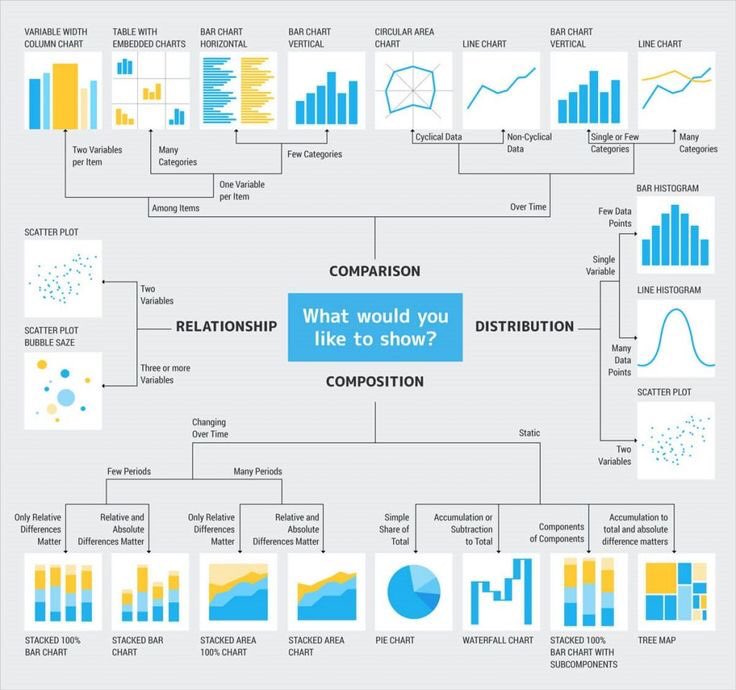

Lastly, can a flashcard move beyond just recalling text, and instead use images to solidify our understanding of abstract concepts

Would be interested in hear y’all’s thoughts on whether this kind of visual framework can help learning

Crowd Pleasers

DOGE is sad, but this is funny

This is such a hilarious 404 page from the Financial Times — I actually think there’s a valuable template here to compare and contrast different economic viewpoints on every issue

Mind-Benders

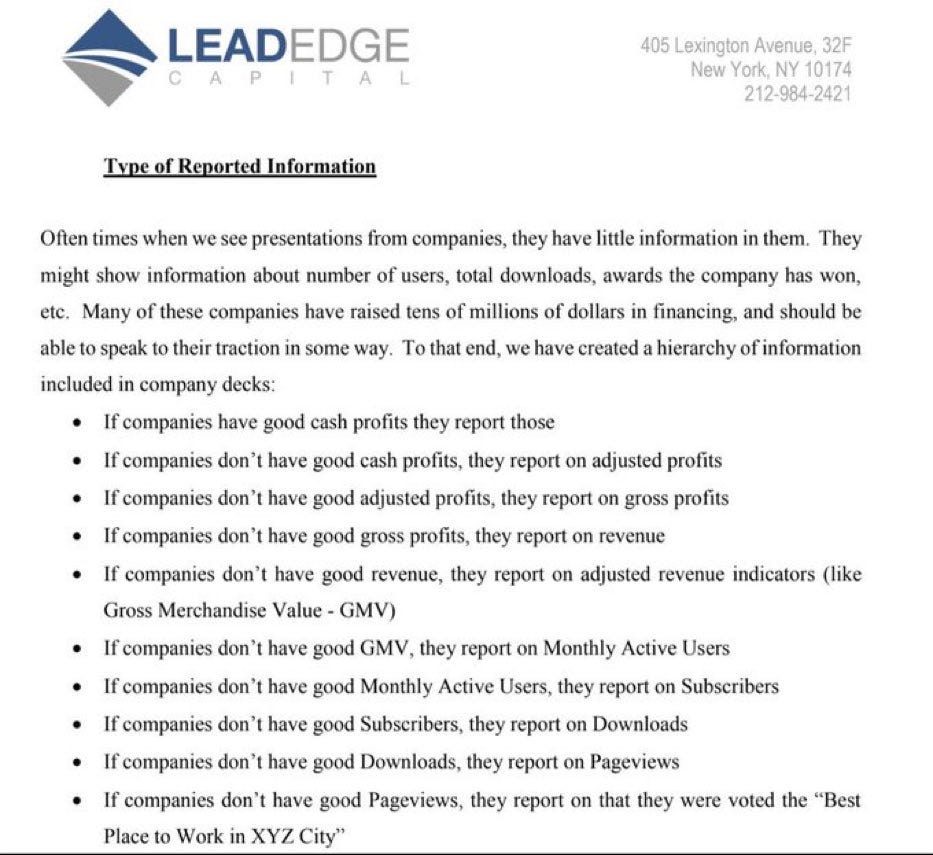

All high-quality businesses use the same metric, all struggling businesses come up with their own metric…

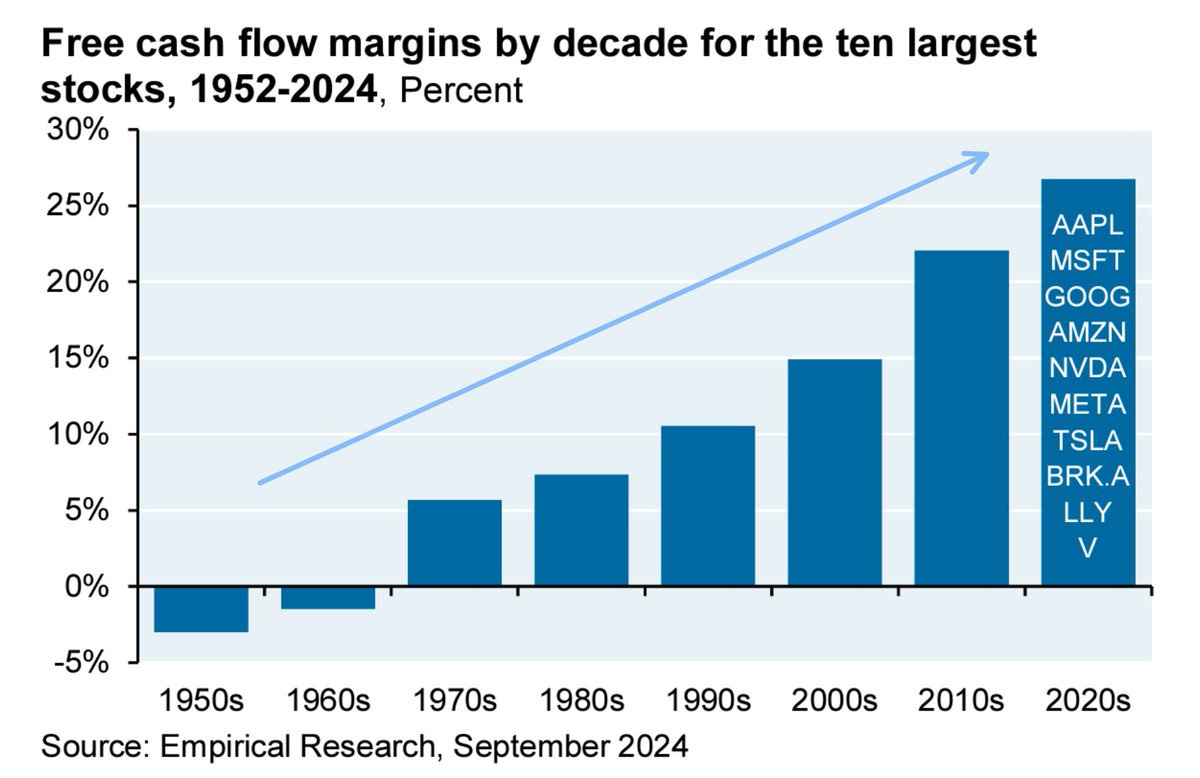

80% of "ten-baggers" (stocks that increase 10x in value) were profitable and traded at a P/E ratio of ~15. Valuation becomes a more reliable predictor of returns the longer you hold the stock.

What’s wild though is that the free cashflow margins for the top 10 stocks has 5x-ed over the last half century! I guess this justifies P/E ratios being higher than historical averages because our top companies are getting better at retaining profit